Car Purchasing Habits – What are Brits Looking for in a Car?

A car is a considered purchase, and many factors play into the decision-making process. From the most desired car features to transmission and fuel type preferences, car buying habits differ for everybody. So what are British motorists looking for in their next car? And how do habits and preferences differ depending on region and generation?

We launched a study to find out exactly what matters most to Brits during the car-buying process and why. Curious to find out what we uncovered? Delve into the responses and our analysis below.

Method

To find out the car purchasing habits of Brits, we surveyed a selection of British motorists on their thoughts. The survey included questions about things people look out for in a car, how they tend to purchase, the most desired features, whether they buy new or older cars, fuel types and more.

We also analysed search data from analytics tools such as Google Trends and Historic Search Volume data around the time of day that people search for cars for sale, as well as demand for petrol, diesel and electric cars over the past two years to compare to what was uncovered in the survey.

How Do Brits Feel About Their Car Currently?

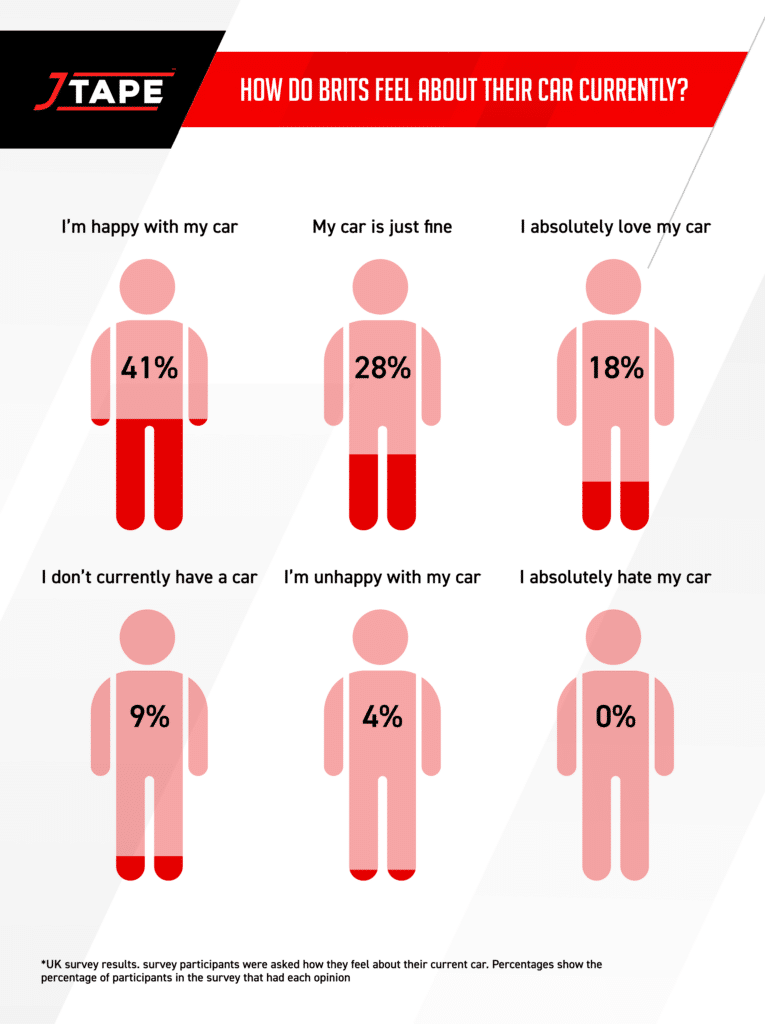

Our survey found that most Brits are ‘happy’ with their car, with 41% of participants responding positively. Meanwhile, more than a quarter of participants (28%) gave a more average response, stating that their car is ‘just fine’.

Almost 1 in 5 (18%) admit to absolutely loving their car. And on another positive note, nobody in the survey said they ‘absolutely hate their car’, although 4% admitted being unhappy with theirs.

Overall, this suggests that most Brits have little to no problems with their car and generally feel quite positive about it.

Method of Purchase & Options

Ranked by Popularity: Methods for Purchasing a Car

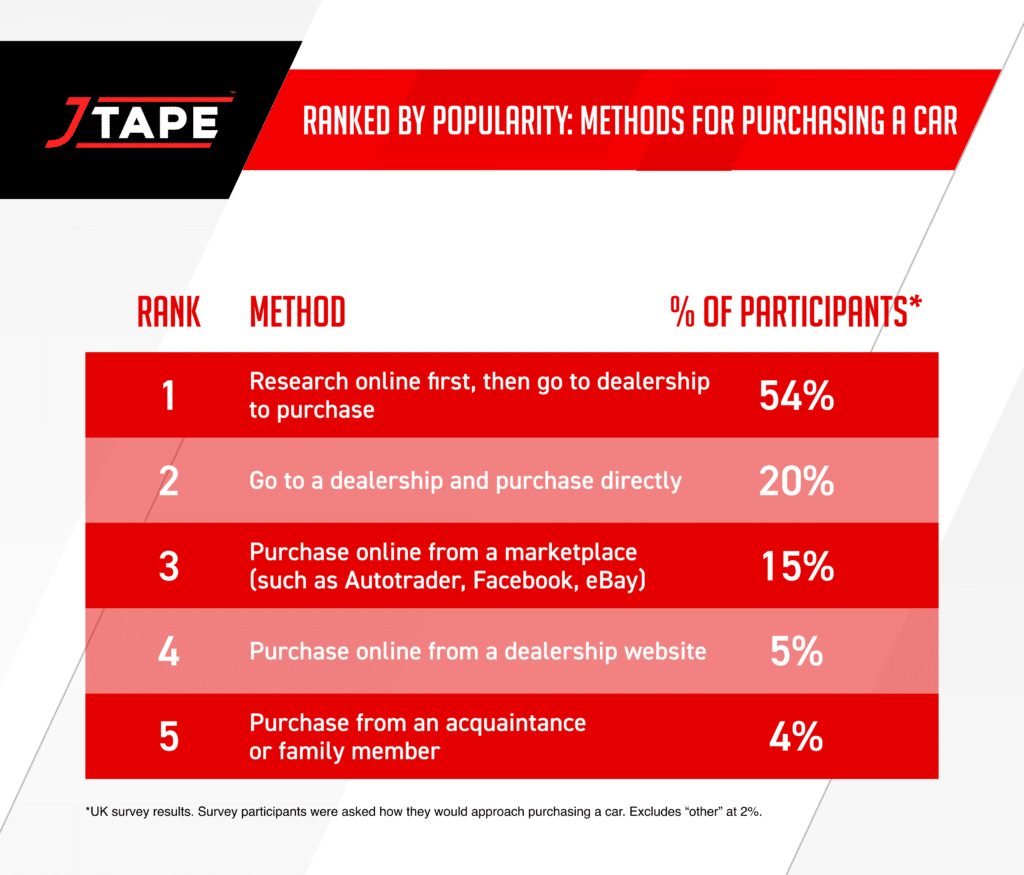

Researching online first, and then going to a dealership to purchase is currently the most popular method of buying a car, with over half (54%) of participants stating that this is their way to go. The next most popular method was to simply go to a dealership and purchase directly – with 1 in 5 (20%) choosing this.

15% said they’d prefer to approach buying a car by simply purchasing online from a marketplace like Autotrader, Facebook or eBay, which outweighed the 5% that said they would purchase online from a dealership website. This could be due to the wider range of options available from online marketplaces in comparison to dealership websites.

How Far Would Brits Travel to Collect a Car to Purchase?

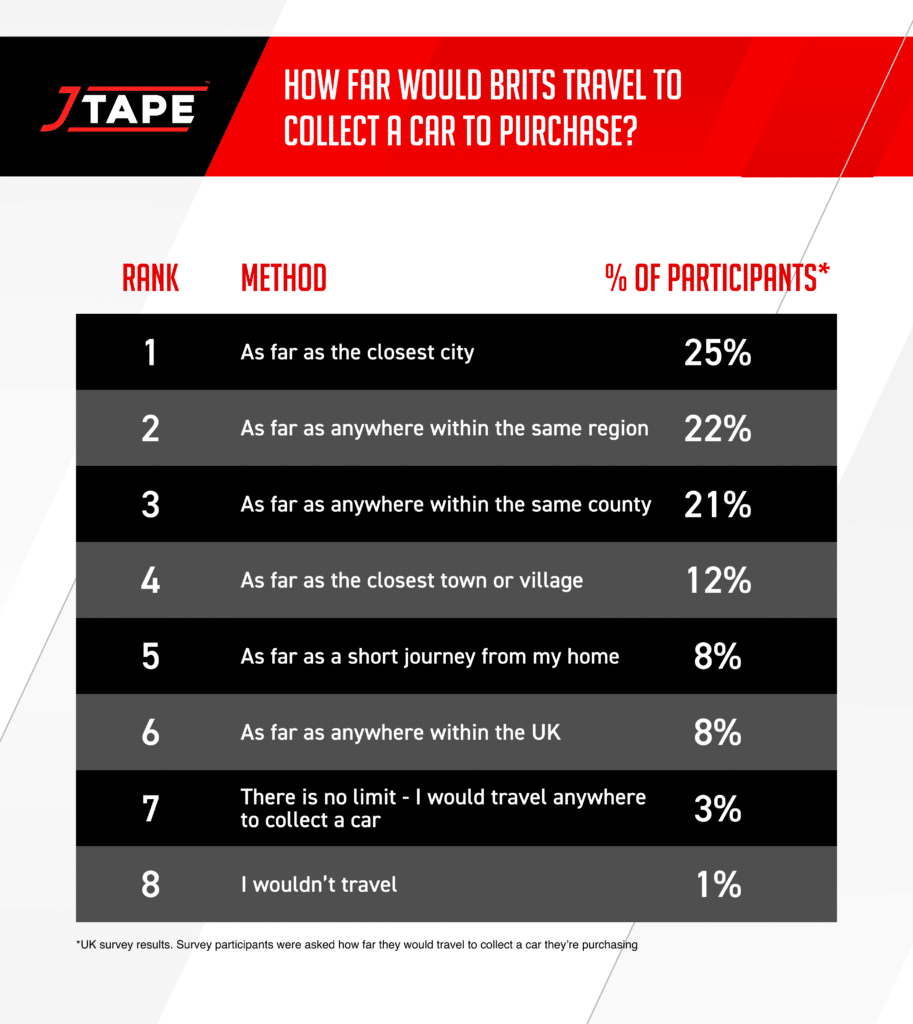

When asked how far they would travel to collect a car that they were purchasing, a quarter (25%) of Brits stated the furthest they would travel would be to their closest city. Just over 1 in 10 (21%) said they would travel within their county, while slightly more (22%) would travel anywhere in their region to collect a car.

Some were willing to travel hundreds of miles, with 8% being willing to travel anywhere as long as it was in the UK, and 3% even stating that they put no limit on how far they’d travel to collect a car they were purchasing, implying they’d consider going overseas just to purchase a car.

In some cases, travelling to collect a car to purchase can seem like a good option. Whether prices for the make and model you’re searching for are cheaper elsewhere or your desired features are rare and difficult to track down, taking a trip to another city or even another country can seem worth it!

Car Purchasing: Reviews & Test Driving

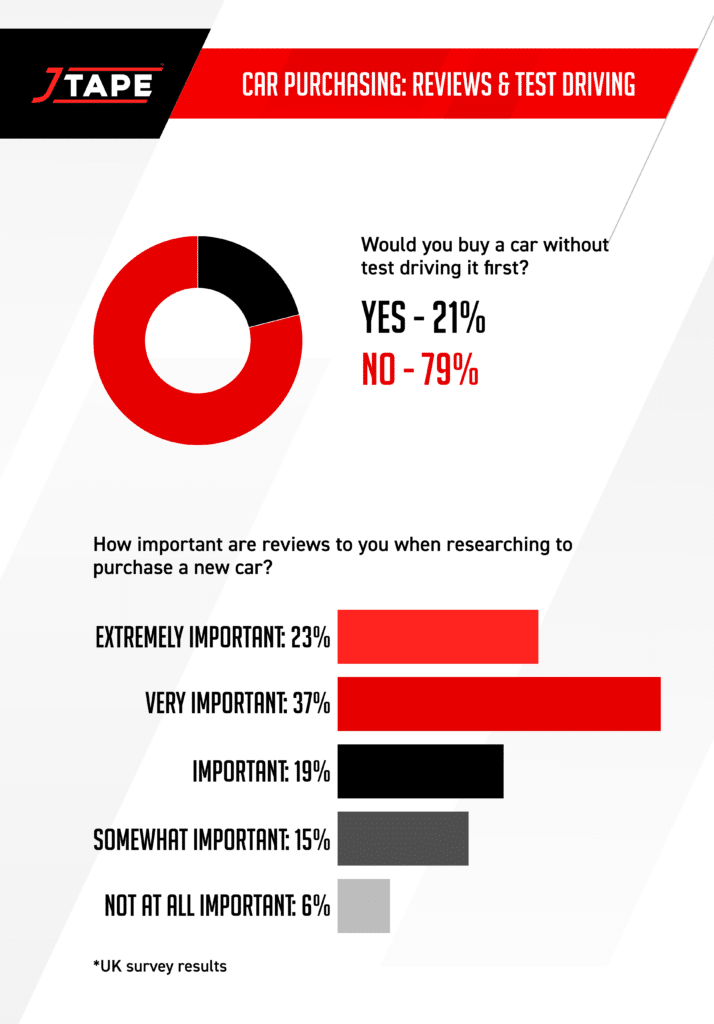

Test drives are often offered to give drivers a feel for the car and see if they enjoy driving it. Over 1 in 5 admitted they’d purchase a car without test driving first, although the majority of participants (79%) agreed that a test drive is a must when purchasing a car.

Reviews are certainly important to potential car buyers, which is to be expected with a considered purchase. When asked about reviews, the majority of participants (37%) said they were “very important” to them when looking to buy a car, followed by almost one quarter (23%) that view reviews as being “extremely important” for their decision.

19% said reviews are “important”, and 15% said “somewhat important”

In total, nearly all of our participants (94%) admitted the importance of reviews. Whether they rely heavily on reviews or factor them into the decision at some point along the way, they can influence our car purchasing habits. Just 6% stated that reviews are “not at all important” when buying a car, meaning they don’t tend to use reviews to help them decide whether to purchase a car.

Car Preferences

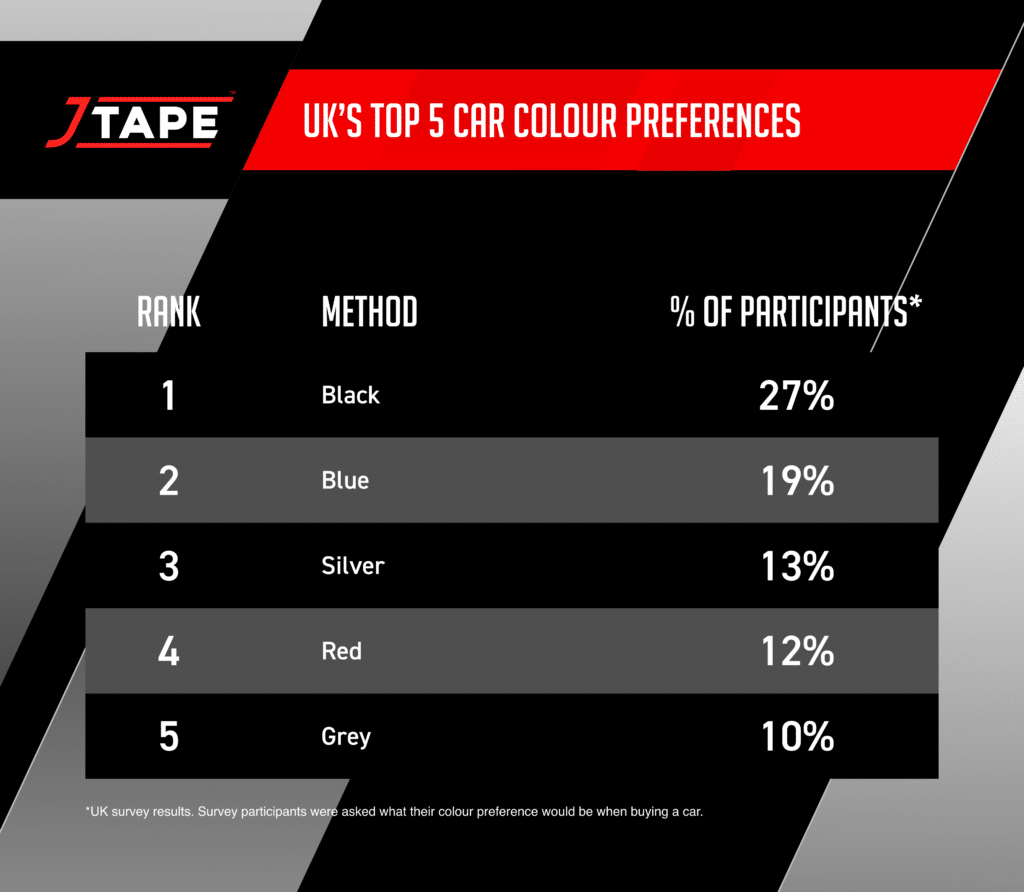

UK’s Top 5 Car Colour Preferences

Black was the most popular car colour preference taking the majority vote with over a quarter of participants (27%) choosing this as their favourite. The second top choice was blue, with just under 1 in 5 (19%) choosing this colour. Other popular options were silver (13%), red (12%) and grey (10%).

The top choices could be down to how easy car owners find it to clean and maintain these paint colours. However, it could also be partially influenced by the stock colours of their favourite makes and models.

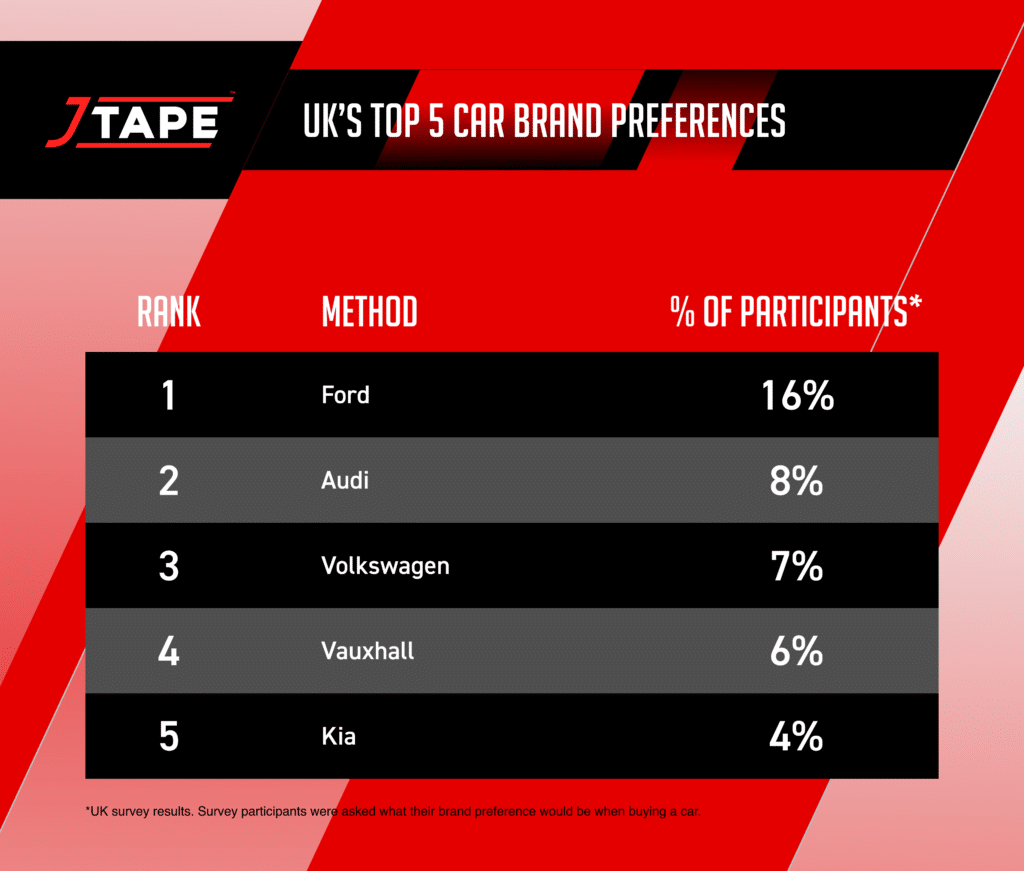

UK’s Top 5 Car Brand Preferences

The number one chosen car brand seems to be Ford, with 16% selecting this as their favourite out of all car brands. This is likely due to their affordability and reliability, as well as the fact that the beloved Fiesta model has been winning the hearts of Brits for many years. The Fiesta model has now been discontinued, with the final cars produced in June 2023. Could this impact the future answer to this question?

Audi came in second place with 8% of participants choosing the brand, followed by Volkswagen at 7%. German automotive engineering is often said to be the best, and its popularity with British motorists only supports this.

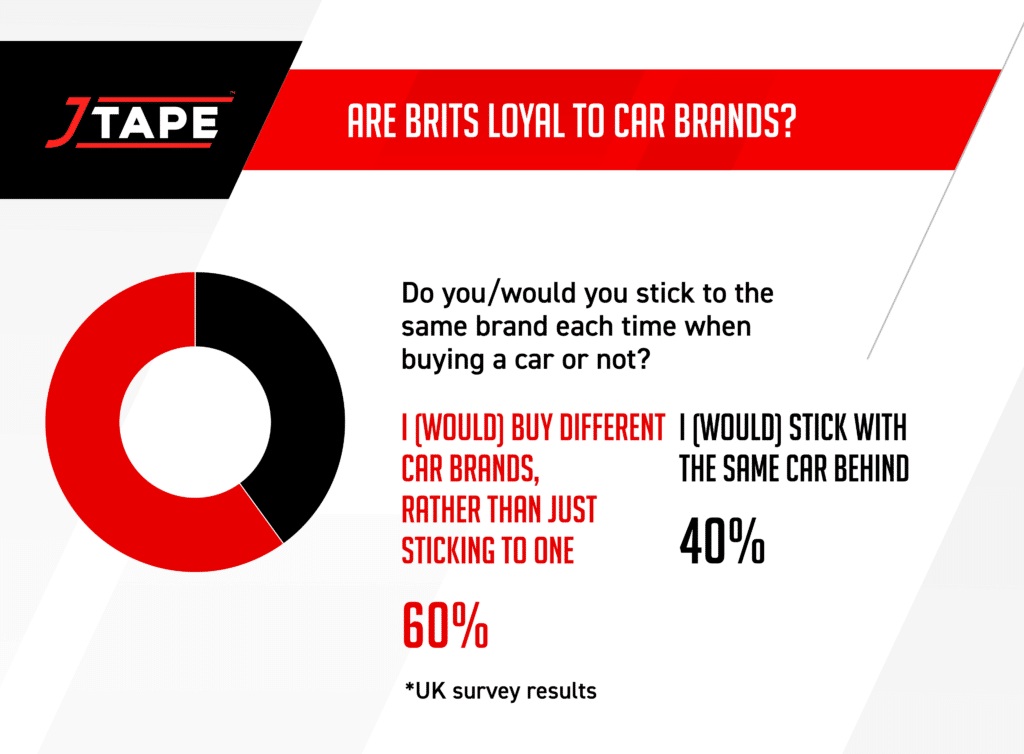

Are Brits Loyal to Car Brands?

Although British motorists have some clear favourites when it comes to car brands, we wanted to know whether they’d also remain loyal to these brands for their next car purchase.

When faced with the question of sticking to the same brand upon each car purchase, 3 in 5 (60%) Brits were brand-agnostic, stating they would buy different car brands rather than just sticking to one. One of the most popular reasons for this answer was that purchase enjoyment was a big factor.

The other 40% of participants stated they prefer sticking to brands, which means there are a good number of Brits who stay brand loyal when it comes to car purchasing.

The UK’s Car Preferences

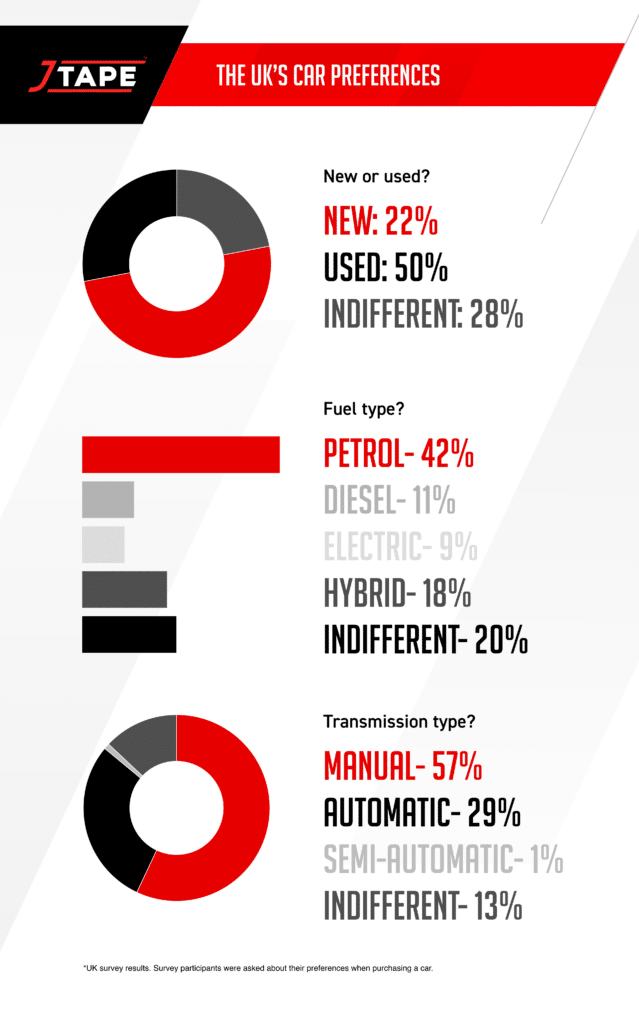

Used car prices are expected to drop in 2024 after a sharp increase in price over recent years. Half of our participants (50%) said they’d choose a used car so would be pleased by this news, however, 22% stated that they would choose a new car if purchasing a car, perhaps due to the recent prices of used cars, or simply the thrill of purchasing a car with no previous owners.

In terms of fuel type, petrol was the clear winner here with 42% choosing this as their preference. It appears that hybrid is becoming increasingly popular though, with 18% of participants choosing this option. Diesel was the third most popular choice as over 1 in 10 (11%) responded that this is their preference. Finally, electric received the lowest number of participants’ votes with just 9% saying they’d choose this fuel type. The switch to fully electric vehicles doesn’t appear to be popular based on these responses.

Alongside this, 20% of motorists were indifferent towards their preferences for fuel type. This is interesting because it suggests that a large proportion of British motorists don’t think about the fuel type when purchasing a vehicle.

When it comes to transmission, manual was the clear winner with 57% of participants choosing this as their preferred option. Automatic came 2nd at 29%, and semi-automatic received just 1% of participant votes.

Again, 13% were indifferent – they don’t have a transmission preference and are happy to drive with any type. In essence, this concludes that Brits’ “ideal” car for purchase would be a used petrol car with a manual transmission!

Opinions on Switching to Electric/Hybrid

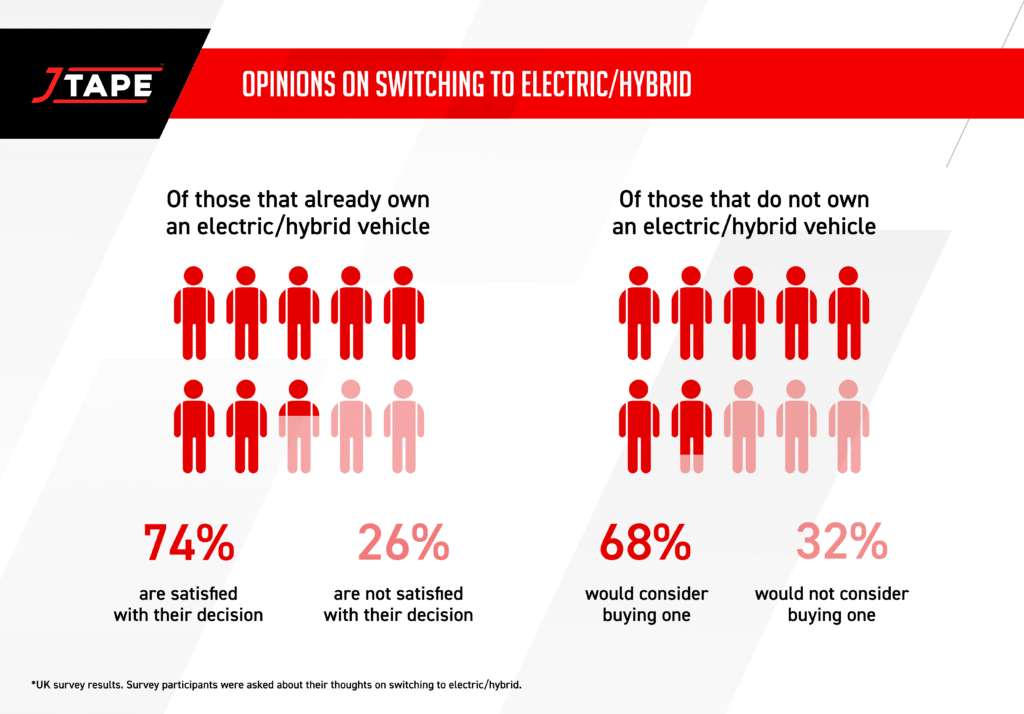

14% of our participants currently own an electric or hybrid vehicle. Of these 14%, we found that just under three-quarters (74%) were happy with their decision to go electric, but over a quarter (26%) weren’t satisfied.

The majority of participants don’t currently own an electric or hybrid vehicle. Of these participants, we found that 68% would consider purchasing an electric/hybrid vehicle, while the remaining 32% wouldn’t even consider it. This is quite a positive reaction for hybrid and electric vehicles which suggests that people are open to trying these eco-friendlier types of vehicles.

Search Trends for Petrol, Diesel & Electric Cars for Sale

The Government’s proposed ban on the sale of new petrol and diesel cars was introduced in 2020, with the ban set to come into force in 2030. In September 2023, the ban was delayed until 2035.

Below, we’ll take a look at search data from 2022 and 2023 for key search terms.

“Electric cars for sale”

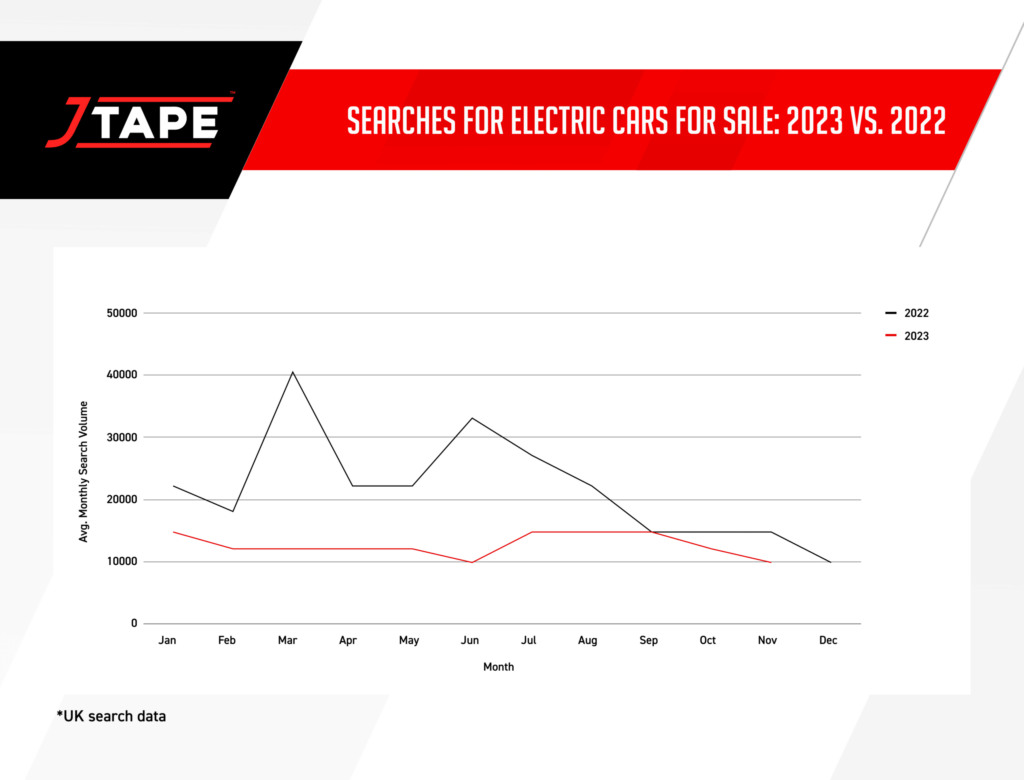

Searches for “electric cars for sale” saw a much higher volume in 2022 than in 2023 overall. 2023 has been a difficult year financially for many due to the cost of living crisis, which might explain why there were fewer searches for this topic. Electric cars are generally more expensive than ICEs even if they’re bought second-hand.

2022 saw a massive spike in March with 40.5K average monthly searches for electric cars for sale. This could be because new license plates are launched in March. However, this increase was followed by a sharp decline in April down to 22.2K average monthly searches. In 2023, we didn’t see a similar trend, and instead, search volumes remained steady.

June 2022 saw an incline, with 33.1K average monthly searches, yet June 2023 did not replicate the same trend and actually saw a slight decline in searches for electric cars for sale (9.9K searches).

With the Government announcement at the end of September 2023 regarding the ban being pushed back to 2035, searches for electric cars for sale declined in October 2023 by around 18% (12.1K searches in October vs. 14.8K in September).

“Petrol cars for sale”

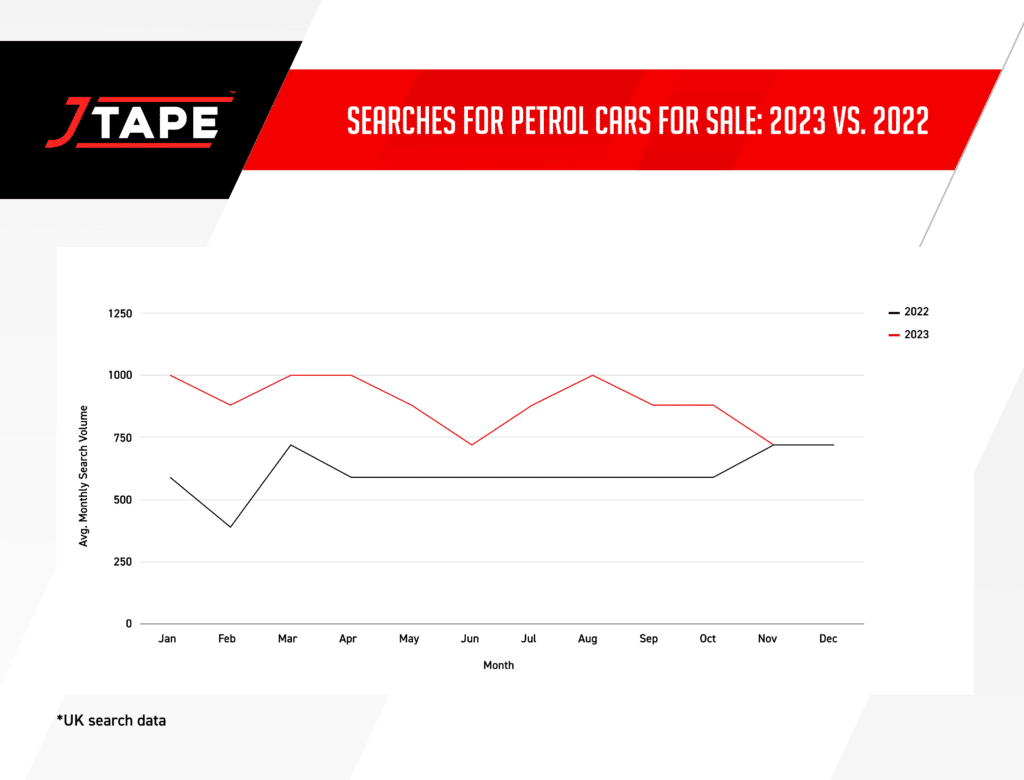

Searches for “petrol cars for sale” were much lower than those searching for electric cars overall, which is unusual considering our survey results revealed that petrol was the most preferred fuel type in the UK. However, this also may be because people don’t search by fuel type when looking for petrol cars, as ICEs are more “the norm” and may not require the extra detail to find.

Search volumes for petrol cars increased in 2023 compared to 2022, which again ties in with them generally being more affordable than electric vehicle options. The trend for searching for petrol cars for sale saw a lot of peaks and troughs in 2023, with declines in February, May, June, September and November.

2022 was a steadier year in terms of trends for petrol cars for sale, although saw a similar decline in February, along with an uplift in March. Interestingly, November 2022 saw an uplift in searches, whereas November 2023 saw a decline.

The announcement of the ban being delayed in September 2023 didn’t appear to directly affect search volumes for petrol cars, as the search volume trend between September & October 2023 remained steady.

“Diesel cars for sale”

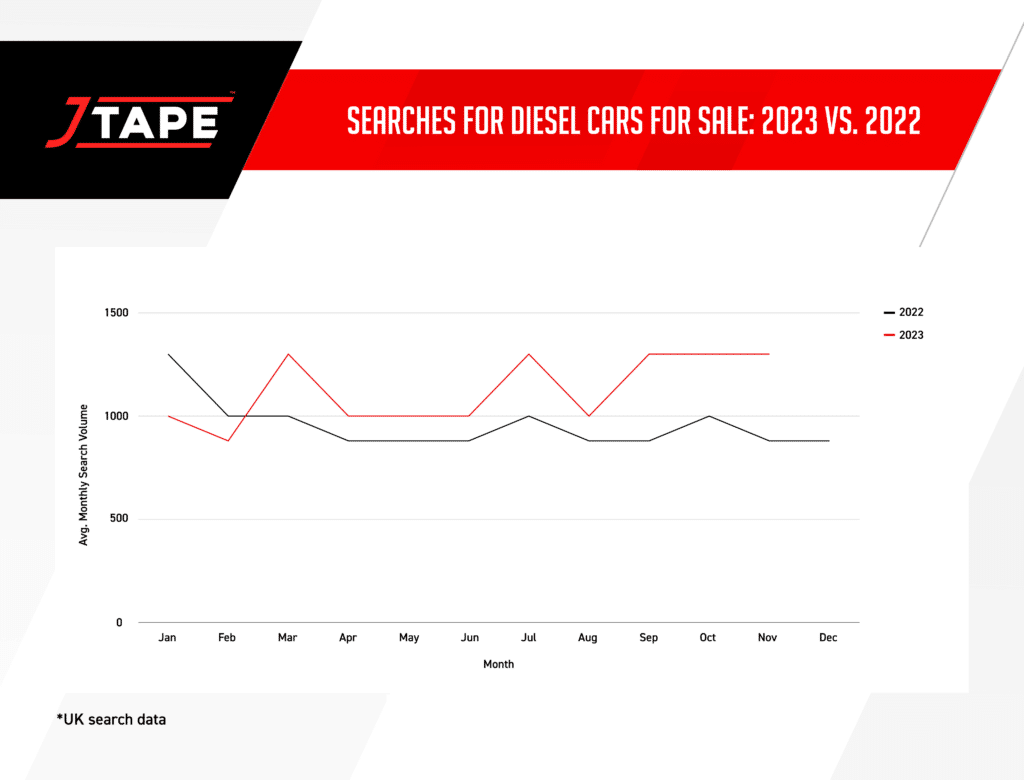

Search volumes for diesel cars for sale also increased in 2023 compared to 2022. This is likely to be because ICEs are the more affordable option generally compared with EVs and the country has been experiencing more financial difficulty in 2023.

Despite this, searches for diesel were also much lower than for EVs overall – a similar story to petrol with regards to potentially being due to the way people search for ICEs.

The announcement of the ban being delayed in September 2023 also didn’t affect search volumes for diesel cars – the trend between September & October 2023 remained steady.

We saw some uplift in March 2023 for diesel car searches, aligning with launches of new plates.

What Matters Most?

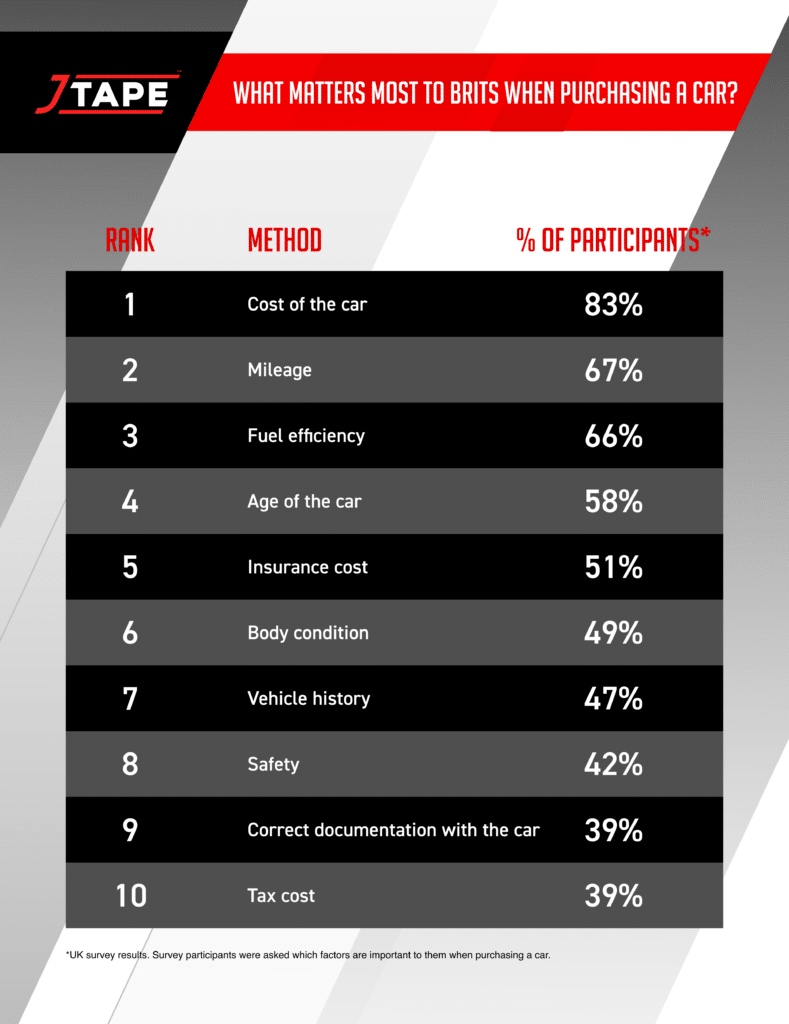

What Matters Most to Brits when Purchasing a Car?

Perhaps unsurprisingly, cost was the most popular important factor to Brits when purchasing a car, with 83% of participants selecting this when asked about what is important to them when purchasing a car. Following, but not notably closely, came mileage (67%) and fuel efficiency (66%).

Of the top 10, only one factor was focused on the aesthetics of the car – body condition at 49%, proving Brits are generally very sensible when it comes to choosing a vehicle based on things such as safety, fuel efficiency, documentation and costs.

Of the top 10, 3 factors focused on costs. 83% said the cost of the car mattered most, while 51% said the cost of the insurance was the most important factor. 39% said they thought the tax mattered most when purchasing a car.

Most Desired ‘Nice-to-have’ Features for Brits Buying a Car

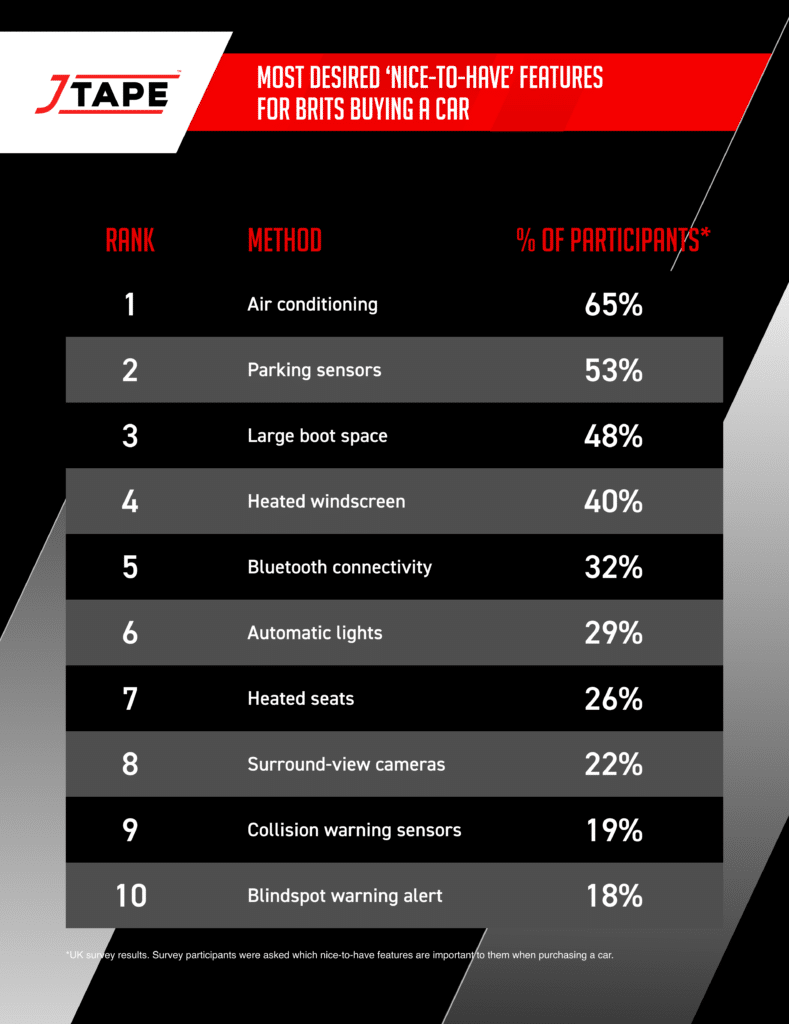

Of ‘nice-to-have’ features, air conditioning was the most popular choice for Brits, with 65% stating this as a “must have” when purchasing a car. This was followed by parking sensors, with over half (53%) stating that these are a must

The top 10 list of most popular ‘must have’ ‘nice-to-have’ car features resulted in a good mix of safety features (such as parking sensors), comfort features (such as heated seats) and convenience features (such as Bluetooth connectivity).

What Time of Day are People Searching for Cars for Sale?

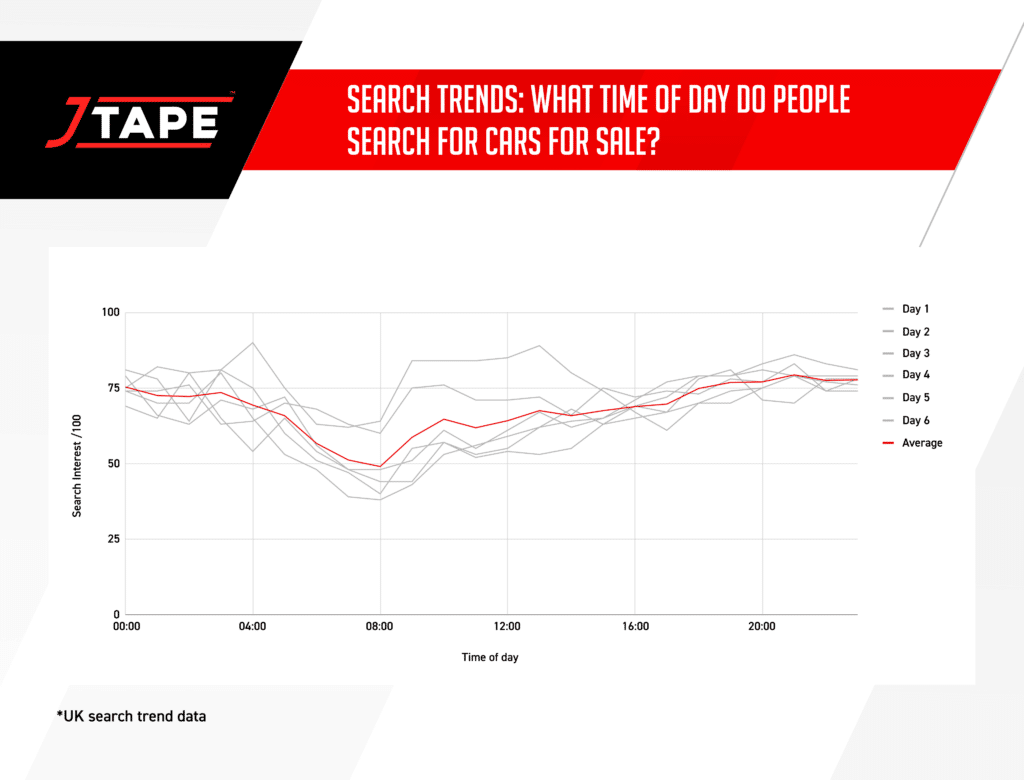

We gathered hourly search interest data across six days to uncover the average time of day that’s most popular for people searching for ‘cars for sale’.

From this data, on average, the most popular time of day for searching for cars for sale is 9pm, with an average search interest of 79/100. This was followed very closely by 10pm & 11pm, each with 78/100 average search interest. The least popular time of day for searching for cars for sale is 8am, with an average search interest of 49/100 at this time.

Interestingly, there are spikes in interest in the early hours of the morning and the middle of the night, with average search interest over 70 for each hour from midnight until 4am. Perhaps those who are struggling to sleep and looking to fill some time do so by searching for cars for sale!

Regional Results

How did the results look by region? Below is a breakdown of how car preferences differ depending on the UK region.

Car Preferences by UK Region

Ford is the most popular brand across all UK regions, apart from in Northern Ireland where many brands received the same percentage of votes.

In terms of colours, black takes the lead, however, the East of England and Northern Ireland thought otherwise, with blue as the general favourite in these regions. The East Midlands defied all other regions and went with white as their top choice.

Petrol was the favourite type of fuel across all regions, apart from Scotland which was mostly indifferent and didn’t mind which fuel type their car had, and Northern Ireland where hybrid took the lead. Manual was the favourite transmission type across all UK regions, apart from London, where Automatic took the lead. This could be down to the large amounts of traffic in London which could be easier to tackle in an automatic car.

Finally, used cars are in demand across the country, with all UK regions apart from Scotland (indifferent), favouring used cars – certainly aligning with the used car price spikes due to the demand we have experienced in recent years.

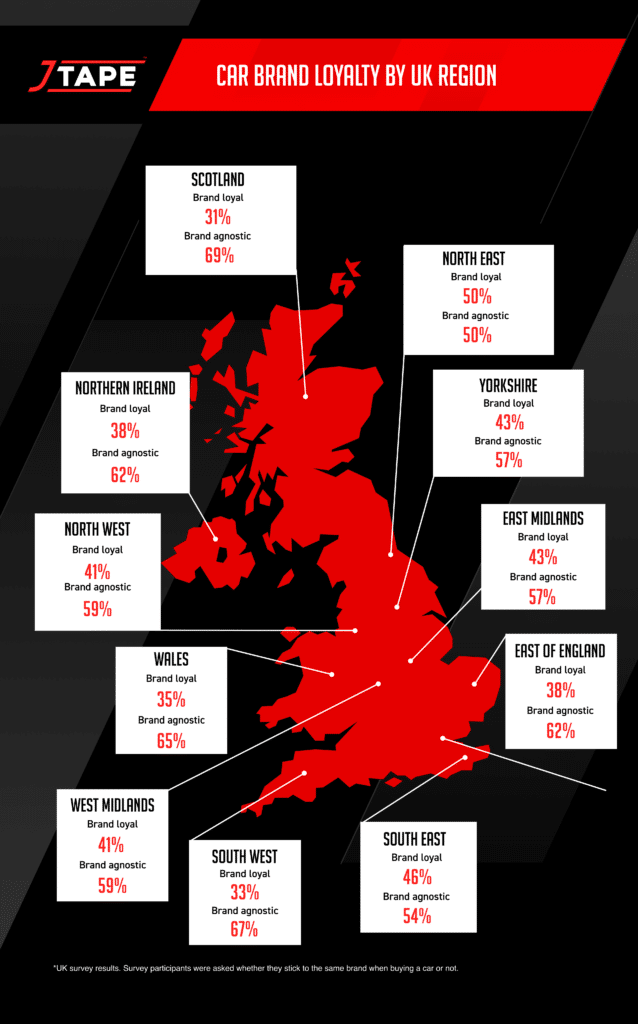

Car Brand Loyalty by UK Region

All regions in the UK were more swayed towards being brand agnostic when it comes to buying a car, apart from the North East which was split directly down the middle! Scotland had the highest percentage of participants who were brand agnostic, at 69%.

The results show that most motorists have little loyalty when it comes to the brand of car they choose to purchase.

Generational Results

Car Preferences by Age Group

Ford is the most popular brand across all age groups, apart from the Silent Generation where no decision was made due to multiple brands having the same percentage, and Generation Z, which was split down the middle by Audi & Ford.

In terms of colours, black takes the lead with younger age groups and Gen X, however older generations were instead swayed by silver cars, favoured by Baby Boomers and The Silent Generation. The Silent Generation was torn between Silver & White.

Petrol was the favourite type of fuel across all age groups – meaning the shift to electric might be tricky for many. Manual was also the leading transmission type across all age groups.

Generation Z were indifferent when it came to car condition – not favouring new, or used, and not being too fussed. On the other end of the spectrum, the Silent Generation decided they prefer new cars. All other age groups said they favoured used cars, which could be down to costs.

Car Brand Loyalty by Age Group

All age groups were more swayed towards being brand agnostic when it comes to buying a car, apart from the Silent Generation, who were more brand loyal – maybe due to their longer experience with cars and knowing which brands are reliable and trustworthy.

Whether you’re brand loyal when it comes to your car purchases or your top priority is purchasing a new vehicle, we hope you’ve enjoyed learning the preferences of British motorists.

At JTAPE, we’re proud experts in automotive masking. Discover our full range of masking solutions on our product page.